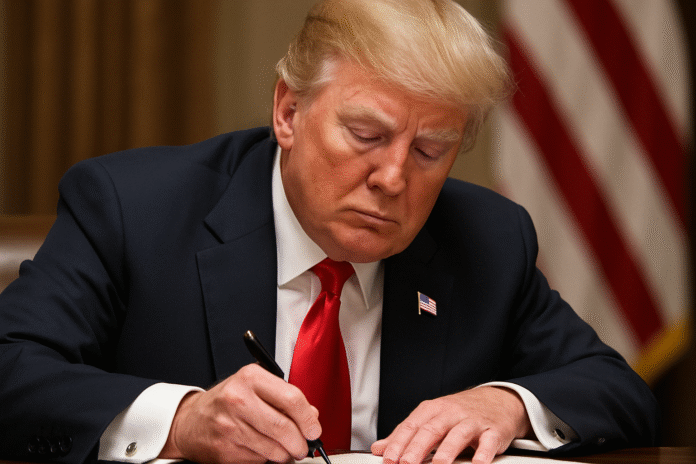

As of July 31, 2025, U.S. President Donald Trump has reaffirmed that his August 1 tariff deadline will not be extended. Countries without finalized bilateral trade deals—including India—are now set to face new reciprocal tariffs of up to 25 percent, along with additional penalty charges tied to geopolitical issues such as India’s trade with Russia.

This article explores the status of U.S.–India trade negotiations, analyzes key bilateral deals the U.S. has already secured, discusses India’s potential responses, and outlines what’s at stake going forward.

Background: Why India Is Targeted

- The U.S. ran a $45.7 billion goods trade deficit with India in 2024, up about 5 percent year-on-year.

- Total two‑way trade reached ~$129 billion in 2024, making the U.S. India’s largest trade partner.

- India’s average applied trade tariff is ~17 percent — among the highest of major economies — while the U.S. average is ~3.3 percent.

These structural imbalances and tariff barriers have drawn sharp focus from the Trump administration, which aims to rebalance trade through aggressive new tariffs and bilateral deals.

Status of U.S.–India Trade Talks

Current Negotiations

- India and the U.S. signed Terms of Reference (ToR) in April 2025, officially opening negotiation for the first phase of a Bilateral Trade Agreement (BTA).

- Indian Prime Minister Narendra Modi and President Trump met in February 2025 and agreed on a vision called “Mission 500”, aiming to boost bilateral trade to $500 billion by 2030. They also laid groundwork for an energy‐import agreement by New Delhi and a 10‑year defence framework.

- Commerce Minister Piyush Goyal confirmed the goal to finalize the first tranche by fall 2025 (around October–November).

Roadblocks to Interim Deal Before Aug 1

- Reports indicate negotiations remain deadlocked over sensitive sectors such as agriculture, dairy, and tariffs.

- Multiple news outlets confirm that an interim mini‑deal is unlikely before the firm August 1 deadline.

- Trump himself has expressed frustration at the slow pace of talks and insists the tariffs will compel a resolution.

India Holding Ground

- According to the Global Trade Research Initiative, India is not significantly worse off compared to countries that already signed deals. Its principled stance has avoided one-sided concessions.

- However, Indian opposition leaders have harshly criticized the government’s handling, calling the looming tariffs a diplomatic and economic failure.

U.S. Trade Deals List (Deals Finalized So Far)

As of late July 2025, the U.S. has struck framework or partial trade deals with the following partners:

- South Korea: Trade framework secured, tariff reduced from 25% to 15% in exchange for $350 billion in Korean investment and $100 billion in U.S. energy purchases.

- Japan, EU, UK, Vietnam, Indonesia, Philippines, Pakistan, and others: Similar framework agreements, with tariffs dropped to a floor of 15–20% below originally threatened levels.

- In total, the U.S. has concluded revised trade agreements with at least 17 countries, including Cambodia and Thailand.

Unlike these nations, India remains outside this group, despite ongoing negotiations.

What Happens on August 1

The Tariff Measures

- Effective August 1, 2025, India is set to face a 25% reciprocal tariff on its exports to the U.S.

- In addition, the U.S. will apply a secondary penalty, tied to India’s ongoing purchases of Russian arms and energy.

- Trump has explicitly made clear that the deadline will not be extended, making the imposition mandatory barring a last‑minute breakthrough dealing.

U.S. Legal Challenges

- Note: In late May 2025, the U.S. Court of International Trade ruled against Trump’s sweeping “Liberation Day” tariffs, invalidating executive authority for emergency tariff declarations under IEEPA. Though this case reflected earlier internal U.S. mechanisms, it does not automatically invalidate new tariffs tied to trade agreements.

India’s Strategic Position & Options

Economic Impacts

- Key sectors such as pharmaceuticals, gems, electronics (e.g., iPhones assembled in India) and textiles are expected to be heavily impacted.

- The Indian rupee dropped, and stock market volatility rose, with economists warning of GDP loss up to ~40 basis points.

Political Response

- Opposition leaders have called for urgent parliamentary debate.

- Shashi Tharoor described U.S. demands as “unreasonable”, hinting India may walk away from talks unless terms are fair.

Diplomatic & Strategic Levers

- India can diversify trade routes via regional frameworks like SAFTA and the Indo-Pacific Economic Framework (IPEF), though IPEF is not a full FTA.

- India may leverage its position in BRICS, the Quad, and strengthen ties with other Asian partners.

Why India Hasn’t Secured a Deal (Yet)

- Unlike countries such as South Korea or Indonesia, India is demanding greater reciprocity on agricultural access, including dairy, walnuts, pistachios, cranberries, and pharma markets—areas where it tightly protects domestic producers.

- Although India has reportedly offered to cut duties on U.S. goods by up to 100%, Trump has shown impatience with the slowness of formalization.

- India insists on fair terms, pushing back on pressure to sign under coercive deadlines.

What Could Be in the Deal

Based on current proposals and framework discussions, a U.S.–India trade deal may include:

- Tariff reductions on industrial goods and pharmaceuticals.

- Expanded access to U.S. agriculture: walnuts, pistachios, cranberries, dairy.

- Energy purchase commitments: increasing U.S. oil and gas imports by India to rebalance trade.

- Long‑term commitments in semiconductors and strategic tech. For example, the Bharat Semi fab project backed by the CHIPS and Science Act represents a key element in U.S.–India tech partnership.

- A 10‑year U.S.–India Major Defence Partnership Framework agreed in February 2025.

Future Scenarios

Scenario A: No Deal, Tariffs Begin as Scheduled

- 25% tariffs take effect August 1, hitting Indian exports hard.

- India could retaliate via WTO dispute or domestic trade policy (~tariff hikes on select U.S. goods).

- Negotiations may resume but under pressure of economic damage and political blowback.

Scenario B: A Last-Minute Mini‑Deal Emerges

- A narrowly scoped interim agreement focused on tariffs in industrial and pharma sectors.

- Agriculture and dairy may remain unresolved but eased tariff levels could forestall escalation.

- May buy time until fall 2025, when broader agreements are targeted.

Scenario C: Full BTA by Fall 2025

- Assuming successful talks by October–November 2025, U.S.–India reaches a comprehensive trade pact.

- Progressive reduction of tariffs on both sides, major investment flows and structural trade liberalization.

- Achieves “Mission 500” goal of $500 billion bilateral trade by 2030.

Key Takeaways

- The August 1, 2025 deadline is now firm, with no extension forthcoming.

- Unlike the U.S.’s deals with countries such as South Korea, Japan, the EU and others, India remains outside finalized agreements.

- India faces serious economic exposure from new tariffs—yet political opposition to conceding too much remains strong.

- Ultimately, India’s negotiation strategy—prioritizing fair terms over speed—could shape its long-term trade future.